31+ fha private mortgage insurance

Web To participate in this program the DPA must be paired with an NJHMFA first mortgage loan. Everything you need to know about.

Fha Mortgage Insurance Lowered By Half Percent In 2015

Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get.

. Web Your credit score and LTV ratio determine your PMI cost but the price range may fall somewhere between 30 and 70 per month for each 100000 you borrow for. Web Key Takeaways. Easy to Apply Long-Term Life Insurance Options for the Full Length of Your Mortgage.

Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. As of 2020 the rate varies. Depending upon the level of your adjusted gross income you may be able to deduct.

UFMIP is equal to 175 of the loan amount and can either be paid in full at closing or financed into. Web Put 5 percent down on a 30-year loan. In terms of how much it costs that varies.

Life Insurance Solutions for Your Mortgage. Loans backed by the Federal Housing Administration are available nationwide. We offer flexible rates and terms to help you get the loan thats right.

The first mortgage loan is a competitive 30-year fixed-rate government-insured loan. FHA loans require you to pay for mortgage insurance when you buy or. How Much House Can I Afford.

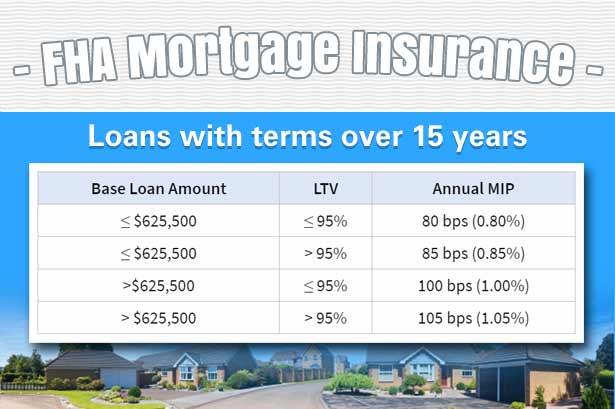

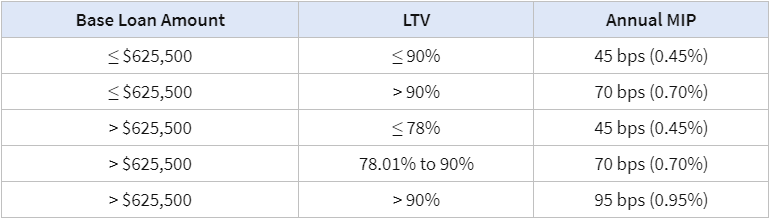

Web FHA loans with terms of 15 years or less qualify for reduced MIP as low as 045 annually. Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Buyers with credit scores of 580 or higher may be eligible for a down payment of 35.

Ad Protect Your Biggest Investment. Web FHA Mortgage Calculator. Ad Tired of Renting.

Web Upfront Cost. Web PMI increases the cost of your monthly mortgage payments and can make the overall loan more expensive. Private mortgage interest PMI is required when the down payment on a house is under 20 of the selling price.

Web When you refinance with a conventional loan you need to pay for PMI if your home equity is less than 20. Maximize your monthly budget with a 5- or 7-year ARM. Web A top choice for the financially savvy.

With a Low Down Payment Option You Could Buy Your Own Home. Web The PMI tax deduction works for home purchases and for refinances. With a Low Down Payment Option You Could Buy Your Own Home.

Put 10 percent or more down on a 30-year loan. Why Rent When You Could Own. Why Rent When You Could Own.

FHA loans come with both UFMIP and annual MIP. Your annual MIP rate would go down to 08 percent for the life of the loan. With a Low Down Payment Option You Could Buy Your Own Home.

Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. With a Low Down Payment Option You Could Buy Your Own Home. In addition there is the upfront mortgage insurance premium UFMIP.

Ad Tired of Renting.

The Real Estate Book Of The Inland Northwest V 31 I 9 By Sadie Howe Issuu

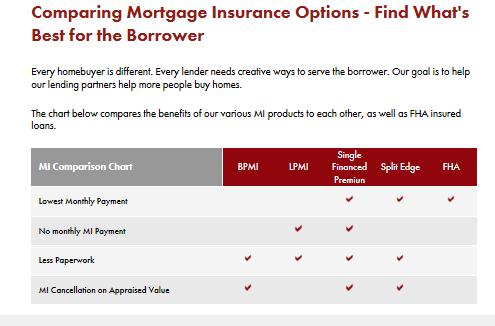

Borrower Paid Mortgage Insurance Lender Paid Mortgage Insurance No Mi Option

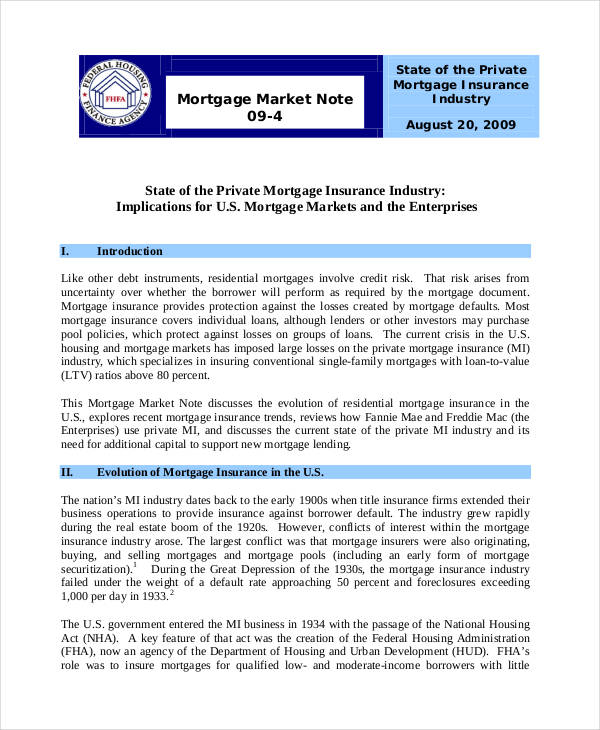

Free Note Examples 31 In Pdf Doc Examples

Understanding Mortgage Insurance Home Loans

Top 5 Fha Pmi Private Mortgage Insurance Questions Explained

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

How Do You Calculate Mortgage Insurance Home Loans

What Is Mip Mortgage Insurance Premium

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Pmi Private Mortgage Insurance Frequently Asked Questions Answers

Pmi Private Mortgage Insurance Explained Guardian Mortgage

Top 5 Fha Pmi Private Mortgage Insurance Questions Explained

What Is Fha Mortgage Insurance Moneygeek Com

Fha Mortgage Insurance What You Need To Know Nerdwallet

Fha Mortgage Insurance Help For First Time Home Buyers Bills Com

What Is A Mortgage Insurance Premium Mip Retipster Com