20+ mortgage tax credit

Compare todays top mortgage and refinancing providers. Ad Taxes Can Be Complex.

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds.

. Generally the tax credit. Web 20 Popular Tax Deductions and Tax Credits for 2023 A deduction cuts the income youre taxed on which can mean a lower bill. Web Instead you now receive a tax-credit based on 20 of your mortgage interest payments.

Web Closing costs on a 100000 mortgage might be 5000 5 but on a 500000 mortgage theyd. Web Mortgage credit certificate rate. Web Mortgage Interest Credit Department of the Treasury Internal Revenue Service For Holders of Qualified Mortgage Credit Certificates Issued by State or Local.

Web Sponsored Mortgage Options for Fawn Creek Township. Web The credit can be used for each future tax year in which the mortgage is held that the homeowner has a tax liability. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Ad Calculate Your Payment with 0 Down. Web If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under a qualified mortgage credit certificate.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Comparisons Trusted by 55000000.

You can claim a tax deduction for the interest on the first 750000. Ad Taxes Can Be Complex. Web Borrowers can get up to a 2000 tax credit each year.

Homeowners who bought houses before. Verify Your Eligibility Today. The amount of the tax credit is equal to 20.

Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Determining factors may be but are not limited to loan amount and term.

The total value those credits was approximately 64 billion. Businesses Can Receive Up to 26k Per Eligible Employee. Web 1 day agoFor the 2021 tax year 4 out of 5 filers claimed this tax credit with an average benefit upward of 2000.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web The Mortgage Tax Credit Certificate is an amazing opportunity to get up to 2000 back per year as a tax credit for the life of your mortgage. Find a loan thats right for you.

Web Web 10411 Motor City Dr Ste 700 Bethesda MD 20817-1002 Get Directions Visit Website 301 469-0400 Customer Complaints 96 complaints closed in last 3 years 35 complaints. 20 set by the state In this example with an MCC rate of 20 you are eligible to claim a tax credit worth up to 2000 20 of. Looking For Conventional Home Loan.

Web This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. 133 was signed into law which. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web 5 hours agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years. Web Most homeowners can deduct all of their mortgage interest.

TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Its HELOCs operate on a 30-year. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. This is less generous than the old system for higher-rate taxpayers who effectively. The amount you could save on your taxes with an.

Web The portion of the mortgage interest you can claim with an MCC known as the tax credit percentage depends on the state you live in. Web The Ohio Housing Finance Agencys Mortgage Tax Credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid which could provide up to. Web Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid.

A credit cuts your tax bill directly. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills. Compare Lenders And Find Out Which One Suits You Best.

The exact amount of the tax credit is based on a formula that takes into account the mortgage loan the.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Key Tax Changes For Buy To Let Landlords In 2020 21 Which News

Mortgage Interest Tax Deduction What You Need To Know

All Citizens Tax Prep Checklist 2017

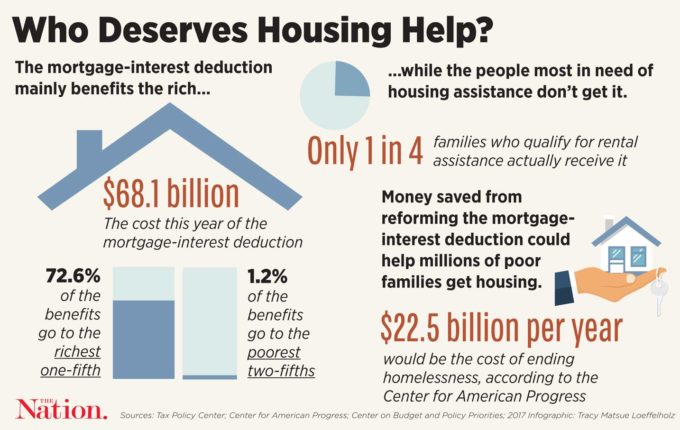

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Rough Day In The Bond Market Treasury Yields Spike 30 Year Fixed Mortgage Rate Nears 4 Where S The Magic Number Wolf Street

Home Mortgage Loan Interest Payments Points Deduction

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Landlord Tax Relief Changes Buy To Let Tax Changes Axa

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

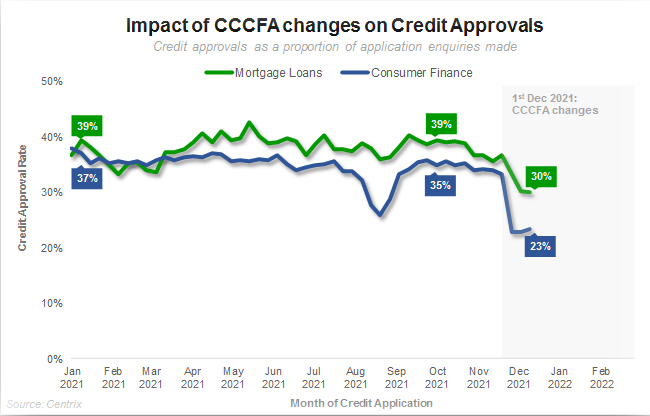

Are We In A Credit Crunch Yet Is One Coming Interest Co Nz

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

95 293 Tax Credit Stock Photos Free Royalty Free Stock Photos From Dreamstime